Fintech Alchemy 101 (Or How I Learned To Love The Law)

By enabling banks to issue stablecoins, the GENIUS Act is enabling a direct upgrade to the core financial system.

Since the passing of the GENIUS Act by the Senate has everyone going on about stablecoins again, thought I’d share some of the frameworks that I’ve long held about financial innovation and how they apply to stablecoins. Lots of this is colored by my perspective as a former lawyer.

The GENIUS Act clearly regulates stablecoins and allows US banks, the core plumbing of the US and global financial system, to issue stablecoins. This is a direct upgrade to the financial system that allows banks to become fintechs in a way that has not been possible before.

All prior major fintech developments are the result of alchemy between new technology and regulatory changes. I think this might be the biggest fintech wave yet.

Stablecoins already exist. Why is the GENIUS Act important?

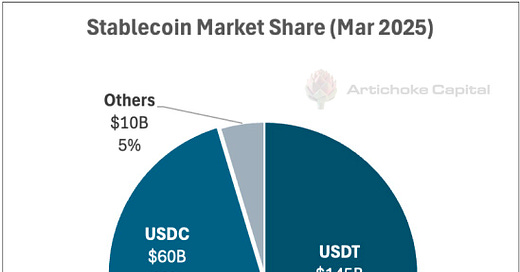

Stablecoins already have a market cap of $250B+. The two major stablecoin companies have "won" with 85%+ market share - almost every crypto-native uses stablecoins already. Why should anyone care about the GENIUS Act?

It's because everything up to this point has just been preparation for the main phase of the big game. And in this game, the TAM is the global financial system: $410 trillion in assets and $7 trillion of revenue.

Study financial history and you realize that every meaningful fintech development resulted from the alchemy of new technology and regulation before it became ready for prime-time: mainstream adoption.

The GENIUS Act provides clarity. Clarity removes the legal risks around stablecoins (tokenized money on blockchains) for entrepreneurs and users; it also provides a high degree of consumer protection (stablecoin holders have super priority in insolvency).

This is the catalyst for network effects to really grow.

A quick history lesson

There are two major historical precedents for mass adoption of fintech in recent memory.

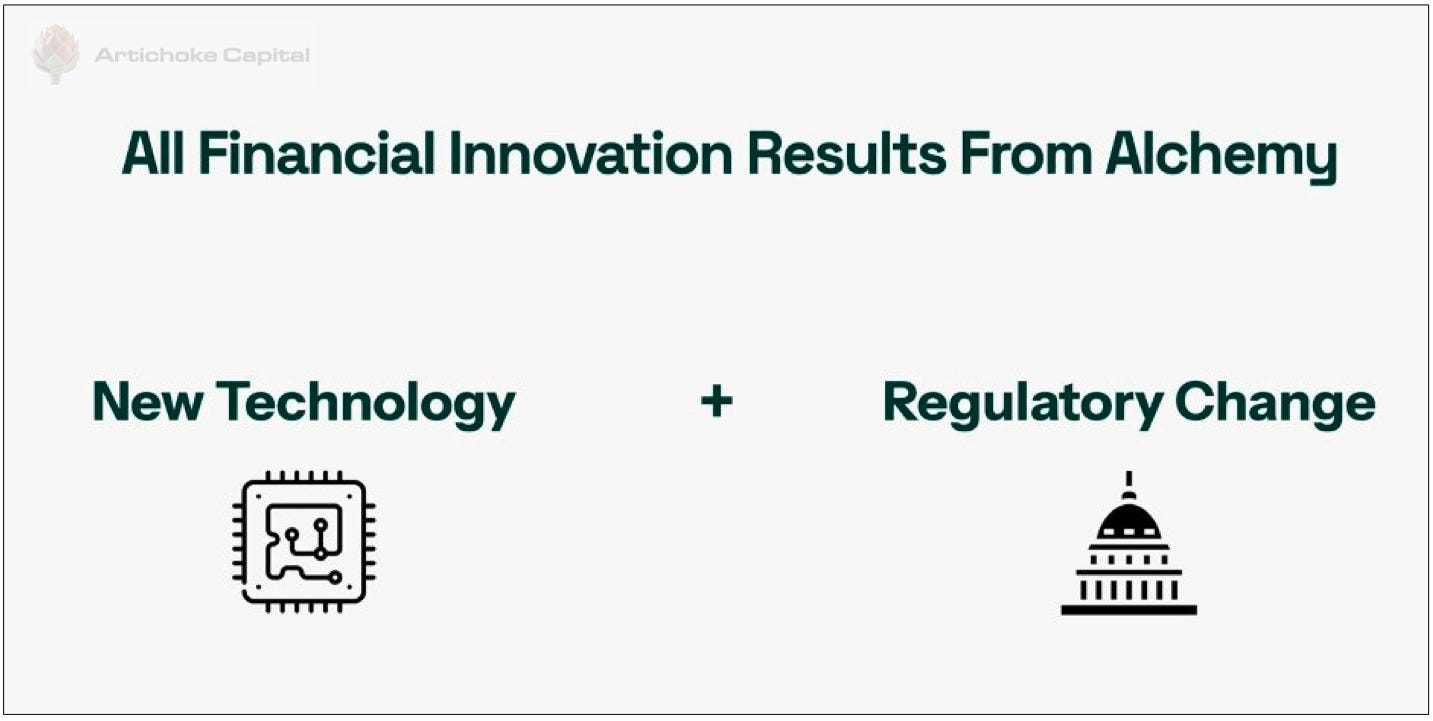

#1 Card Networks

One of the most important fintech innovations in the last century was the creation of the card networks.

The modern charge card was invented by Diners Club in the 1950s as a workaround for the outdated banking system. Note: banking infrastructure was already outdated in the 1950s!

Over the years, card networks developed to enable real-time processing of merchant payments: initially at the physical point-of-sale, and eventually in online commerce.

This was made possible by new technology:

Mainframe computing to process high trhoughput transactions (high TPS!)

Secure data storage in magnetic strips

Telecommunications networks and point-of-sale terminals

Many of these innovations were pioneered by IBM.

The card industry only really began to go mainstream after the 1970s, preceded by several important regulatory catalysts:

Congress passed consumer protection laws around credit cards, in the form of the Truth in Lending Act of 1968 and the Fair Credit Billing Act of 1974.

In 1974, the Federal Reserve Board formally decided that the US government would not build a national POS network (this was the historical equivalent of the modern debates around privately issued stablecoins vs CBDCs).

In the Marquette National Bank v First of Omaha Service Corp case, the US Supreme Court decision effectively deregulated interest rates by allowing credit cards issued by national banks to sidestep state anti-usury laws.

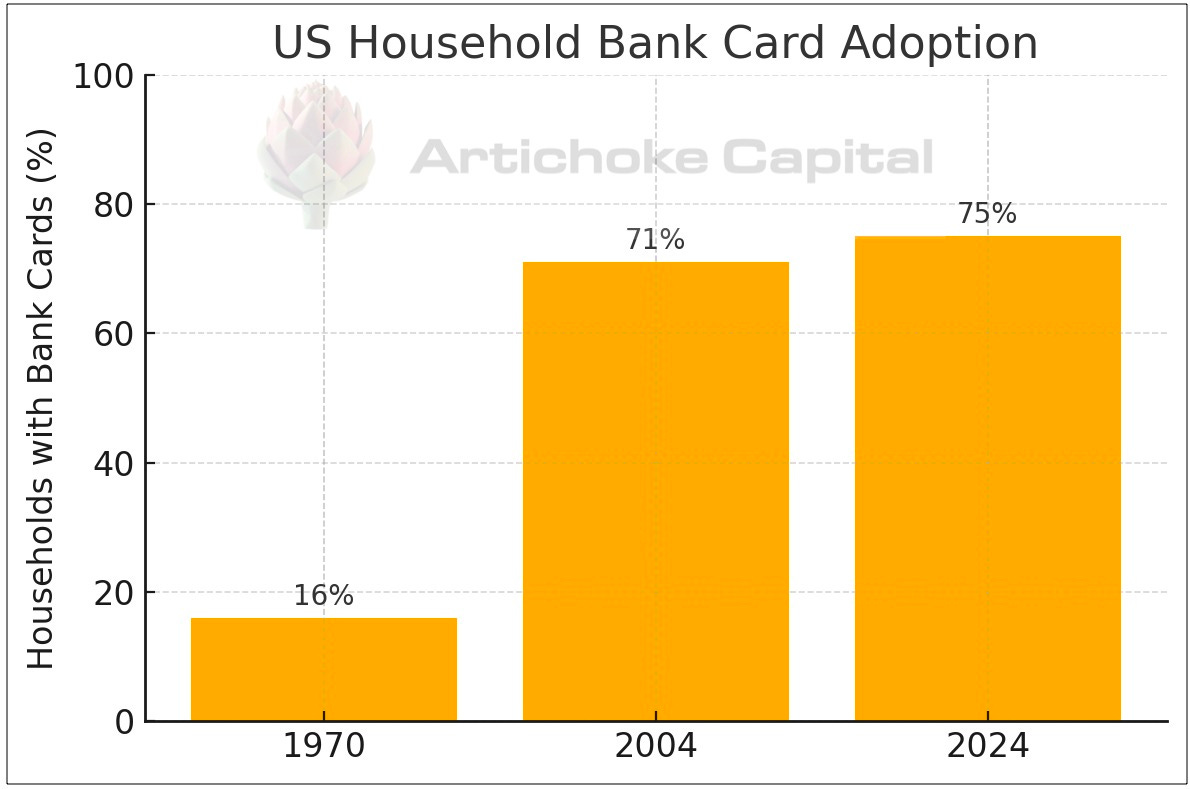

Novel tech x regulatory change resulted in credit cards growing from a niche product in 1970 (16% of US households) to mainstream (71% by 2004).

Three of the largest card networks (Visa, Mastercard, American Express) formed in that era are now massive financial institutions collectively worth $1.5 trillion.

#2 Online Payments

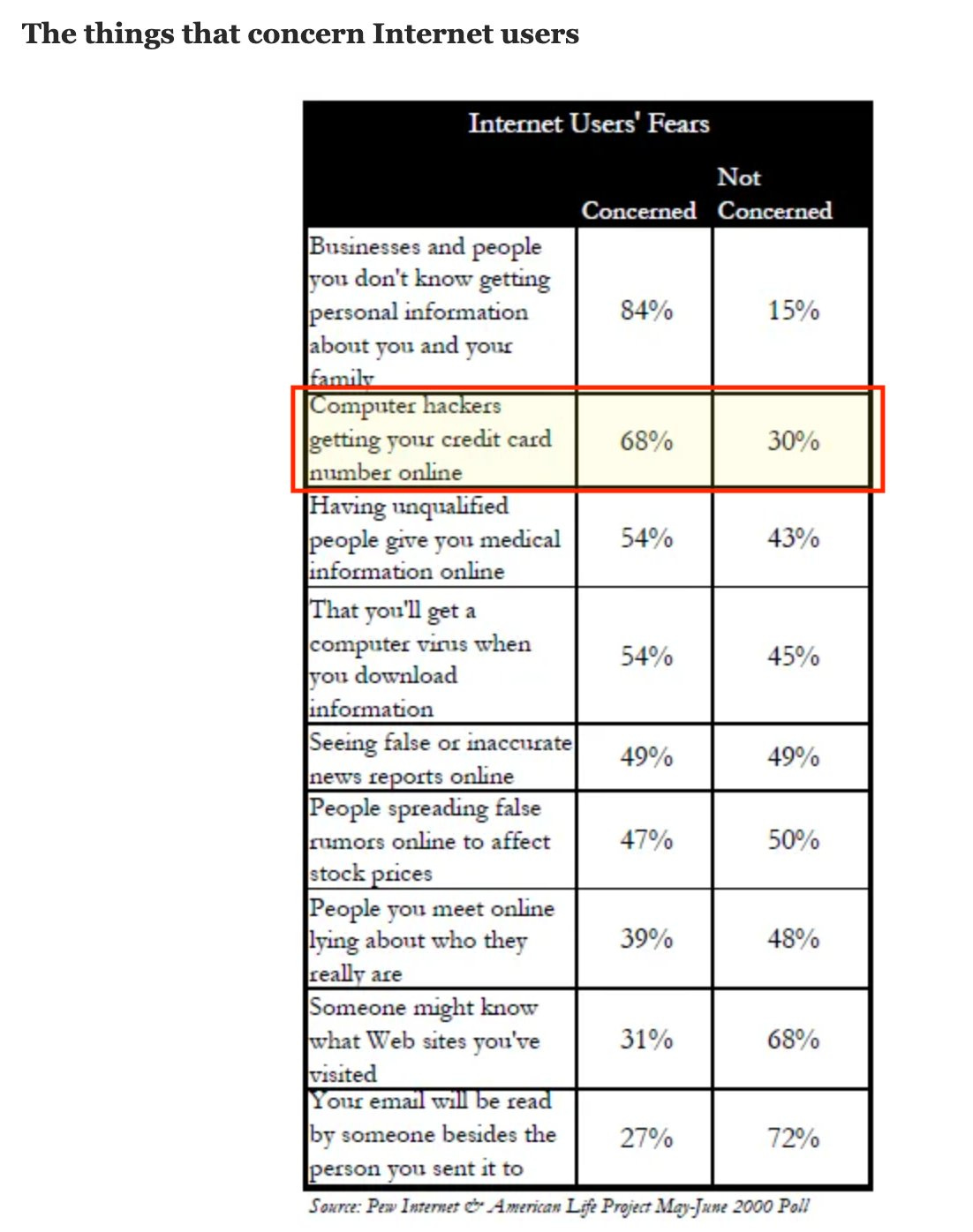

Online payments and e-commerce in the 2000s followed a the same pattern of fintech alchemy.

New technology emerged:

Web browsers (eg Mosaic)

Consumer email (eg Hotmail)

E-commerce platforms (eg AuctionWeb, now known as eBay), and

Secure online encryption (SSL and HTTPS) enabling transmission of sensitive financial data online.

Then, regulatory changes:

Congress passed legislation affirming the legal validity and legitimacy of electronic signatures and contracts (Uniform Electronic Transactions Act of 1999, the E-SIGN Act of 2000).

State money transmitter laws were clarified and provided a framework for nationwide growth of online payment companies like PayPal.

Regulation greases the wheels of adoption

In both cases, the maturation of regulatory frameworks allowed for the underlying technological innovations to scale to the masses through some combination of consumer protection (trust) and ease of access. They also provide comfort to entrepreneurs and businesses: if you follow the clearly established rules, you don't get into trouble. This is the magic of the American system of rule of law that has generated so much economic value over the last century.

Don't we already have fintech?

The idea of upgrading the financial system with technology is obviously not new.

The core problem statement has remained the same: as consumer and merchant needs evolve, how can we facilitate the needs of this economic activity on top of the legacy banking system that was not built for real-time settlement? (Historically, consumers just used physical cash for those transactions.)

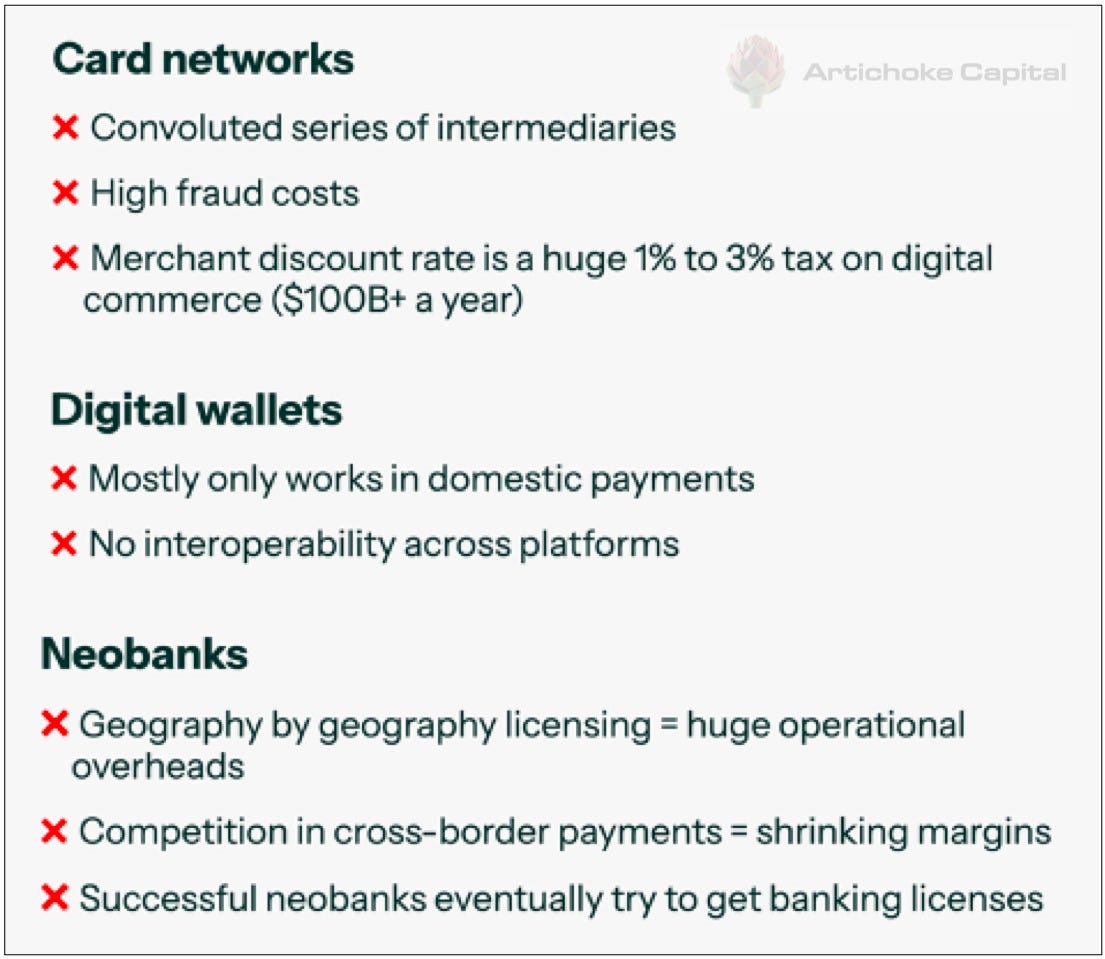

There have been many waves of attempts over the years with different angles of attack. The card networks emerged to process merchant transactions in real time; digital wallets allowed 24/7 transactions with pseudo-bank accounts; neobanks try to solve the terrible experience of cross-border payments in the legacy banking system.

Yet none of these innovations are the end state solution. Most of their troubles stem from the closed loop nature of these platforms that keeps them siloed.

Money is all about interoperability. But the legacy fintech solutions do not work across platforms without reverting to the legacy banking system.

If you're reading this, you already know stablecoins on public permissionless ledgers are great: peer to peer, global, instant, cheap, programmable, accessible to anyone with an Internet connection.

But the truth is stablecoin transfers today only work well if both sender and recipient are onchain.

Airwallex cofounder Jack Zhang recently made a pointed critique on crypto. Many of his critiques are absolutely correct: as they exist today, using stablecoins in the real world comes with lots of friction.

In the current state, stablecoin users have tortured connectivity to existing payment systems. There are limited options for “real world assets” onchain. Stablecoins are a debit-only system with no credit. Tax treatment is often unclear.

The GENIUS Act addresses many of these issues by allowing for the integration of tokenized money and all the onchain infrastructure the crypto industry has developed over the past 15 years with the existing financial system.

My favorite reminder that changing consumer behavior takes time, even with revolutionary technology. Even in 1993, 40+ years after the first charge card was invented, using a credit card to pay for your Burger King meal was perceived to be ridiculous:

This is the most interesting change and upgrade to the banking system in the last half century.

The GENIUS Act opens the door to directly upgrade the banking system. Through stablecoins, banks can now operate at the speed of fintech and modern consumer and merchant expectations.

Elon and the rest of the PayPal Mafia founded the original x.com to be a global financial institution free of geographic barriers

But it was too early.

Post-GENIUS Act, that original vision is becoming realizable.

Post-GENIUS, the window for fintech alchemy is wide open. This is a generational business building opportunity. If you’re an A+ player with financial services experience looking to do something new in fintech, please reach out to us via this form.