Announcing Artichoke Capital

A venture investment firm focused on advancing the development of the web3 and digital assets ecosystem

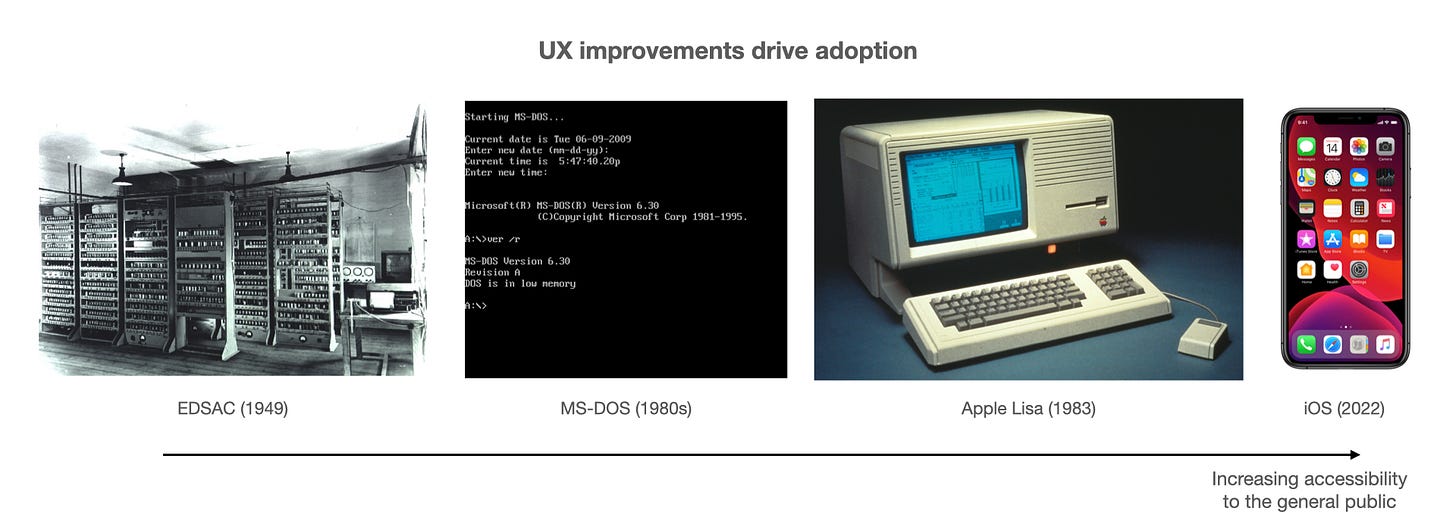

The direction of progress in the development of technology has consistently been one of increasing accessibility and disintermediation.

Modern computing evolved from huge machines, accessible only to well-funded institutions like the military and universities, to more affordable and portable personal computers (from desktops to laptops to smartphones and tablets). Innovations like graphical user interfaces improved the UX of computers to the point where you don’t have to be a computer scientist to operate one of these machines from a command line, broadening the accessibility of computing to virtually the entire population.

Accessibility hasn’t just improved for consumers. Cloud computing and the proliferation of developer tools and open source software increased the accessibility of computing power and engineering leverage for businesses, driving exponential innovation.

Technology is also a means of progressive disintermediation, which improves productivity and efficiency (e.g., online-only direct-to-consumer brands bypassing the traditional retail supply chain), while also making possible entirely new businesses (e.g., two-sided marketplaces for homes (Airbnb) or mobility (Uber)).

Blockchain technology is the latest iteration of innovation in computing and networking

Distributed ledger technology and blockchains are the latest core innovation in computing and networking. Through cryptography and thoughtful economic incentives, well-designed blockchains advance both accessibility (e.g., permissionless computing on a universal, borderless network) and disintermediation (e.g., allowing peer-to-peer transactions or ownership of digital assets without reliance on a centralized intermediary).

Most of the last decade plus since the launch of the Bitcoin network has been about building out Layer 1 blockchain technology and trying to scale blockchains for applications. Crypto natives are familiar with the scalability trilemma: engineers have to balance decentralization, security and scalability when designing blockchain infrastructure — current blockchains typically only get to have two of the three elements.

Ethereum, currently the dominant general purpose smart contract network, favors decentralization and security over scalability, spawning a multitude of competitors that offer higher transaction throughput and lower fees at the expense of decentralization.

With the latest developments around rollups and sharding, the industry is on the cusp of solving the scalability trilemma for distributed ledger technologies.1

With scalable blockchains, the next wave of development in the web3 stack will increasingly be in middleware infrastructure and consumer-friendly applications built atop blockchains. Just like how graphical user interfaces enabled virtually anyone in the world to use computers, web3 UX will advance to reduce technical complexity, allowing more people to build and use applications built on blockchain rails.

Blockchains are the foundational primitives that will power the next wave of innovation & disruption

Base operating systems drawing on the genius of the many are a core part of technology innovation that has changed the way we live. The web, built on open-source protocols, has been the dominant foundational primitive of modern economic and social life for decades.

Centralized platforms like Apple’s iOS or Google’s Android are other examples of base operating systems that have led to a mushrooming of innovation. Since Apple opened its iOS SDK to third-party developers in 2008, millions of apps have been developed and sold through Apple’s App Store, becoming available to users of Apple’s products.2 However, centralized platforms like the App Store benefit from network effects, which has served to concentrate massive amounts of power and influence over the technology ecosystem in the hands of a very small handful of private individuals (see, e.g., Epic Games v. Apple & Google).3

With proper design, blockchains provide a new base “operating system” for developers to build on, without an all-powerful entity that controls the platform enforcing high take rates³ for use of this base infrastructure. We have already seen the initial waves of exponential growth in developers in web3, with over 34,000 new devs committing code in 2021.4 Bubbles in the prices of digital assets drive attention and a fresh influx of developers, while it’s promising that these developers don’t leave the industry even through periods of depressed prices (see 2018-19).

We are in the early days of developing applications with utility on blockchains. Crypto and blockchains have developed largely in a siloed fashion over the past decade, with most development focused on building and scaling blockchain protocols. That is, until “DeFi Summer” in 2020, an early proof of concept for web3 financial applications. Today, over $200 billion in assets are locked in DeFi smart contracts.5

Blockchains and dApps are generating real protocol revenue as utility grows.

We have conviction that web3 will disrupt every industry in the coming decade, beginning with the more digital (e.g., finance & payments, gaming), to the more physical (e.g., entertainment, consumer, retail, supply chains).

Artichoke Capital, investing in the web3 & digital assets ecosystem

Artichoke Capital was founded as a venture investment firm with a long-term outlook to support the buidlers looking to advance the development of the burgeoning Web3 and digital assets ecosystem. We support teams who share our long-term horizons and have the drive to build interesting and useful products on blockchains.

We are a cross-disciplinary team with roots in the crypto industry going back to 2014. As crypto-natives who bring additional expertise in various other fields including technology, consumer, gaming, private equity, investment banking, financial infrastructure, and law. Beyond providing long-term capital, we leverage our expertise and ecosystem of relationships within web3 and industry to assist the projects we invest in.

Our experience as former operators informs our approach as investors. We can empathize with founders going through the stresses, the ups and downs, and the daily grind of execution—all part and parcel of growing a business. We believe this experience helps us be better partners to the founders we back.

Feel free to reach out to us at hello[at]artichoke.capital if you’d like to chat about the web3 & digital assets ecosystem — we are deeply passionate about the space and would love to connect whether you are a founder, fellow investor, or just share a common interest in the development of this space.

With some limited and acceptable tradeoffs around decentralization and security. For more information on the trilemma, see also: Gemini, What is the blockchain trilemma.

Apple and Google/Android typically charge a 30% take rate on app sales and in-app purchases. See The Verge, A guide to platform fees.

Electric Capital Developer Report (2021).

Source: Defi Llama (as of 2 April 2022).